Far from the consensus confidence that dominated most petrochemical markets in China as recently as February 2013, polyethylene (PE) demand growth in China will be flat or negative in 2013, as per ICB. For the third consecutive year, it seems possible that PE growth, and quite likely growth in other resins, will be misaligned with the overall increase in GDP. Chinese converters think that the government is now very determined to deal with corruption, to deflate the property bubble and to slow the economy down. China can no longer be the growth engine of the world. China’s new leaders are playing the “long game” by patiently and persistently pressing ahead with economic reforms. These reforms include the crackdown on corruption. Many opine that corruption has been central to China’s remarkable growth story over the past two decades, as surging investment in excessive infrastructure, high-end properties and industrial capacity has provided huge opportunities for graft. Polyethylene’s position as the largest polymer means that it provides excellent insight into wider developments in the economy, as well as highlighting China’s strategic approach to imports.

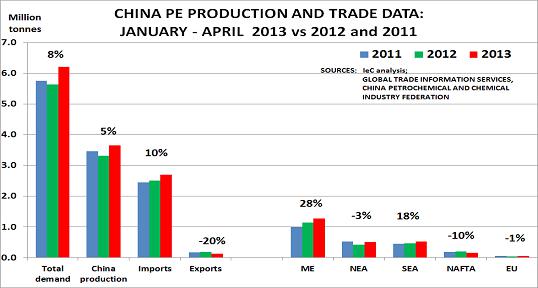

• The overall market is up just 8% (red column) versus 2011 (blue). There has been a welcome recovery versus the decline seen in 2012 (green), but the data highlights once again the lack of connection between PE demand growth and reported GDP growth

• Imports are up 10% and have temporarily gained market share since 2011, with China’s own production up only 5% due to the lack of major new domestic capacity coming online. This situation is now starting to change, as new naphtha and coal-based plants start-up

• Strategic rather than financial concerns continue to drive China’s import sourcing decisions. Its focus is on doing business with the ME (the oil for markets strategic corridor) and SEA (the free trade agreement). Otherwise, its purchases seem increasingly restricted to its need to buy hard-to obtain grades from NAFTA/USA

• Thus ME imports are up 28% and SEA up 18%, whilst NAFTA is down 10%, NEA down 3% and the EU (from an already low volume) down 1%

It is still early days for the new leadership, but PE market developments provide some clear indications of the likely path they intend to follow. But despite the bleak growth environment in China, cost-advantaged global producers continue to see profits, as the Q1 results illustrated. The problem is that the bulk of that profitability is being derived from North American production. If US PE prices fall because of the end of Q1 maintenance work and the start-up of new capacities in the States, several sources worry that more exports might head to China. Many buyers expect prices to start dropping in May 2013 and continue to drop further in June. A further concern is that operating rates at South Korean crackers might be increased ahead of Asia’s peak production season for finished goods, which runs from July/August until September. If low-cost exports from the US increase and the South Koreans push rates higher, the second quarter could be a disaster for Asia’s less competitive PE. The chart illustrates that on a variable cost basis, integrated Northeast Asia high-density PE (HDPE) margins remain only slightly above